What should you consider when choosing payment solutions for an e-commerce store?

Starting an e-commerce store makes me think: Are my payment options good enough for my customers? Choosing the right payment solutions is key to my store’s success. Things like secure payment processing, what payments I accept, and how happy customers are matter a lot. With online payments changing fast, keeping up with new trends and tech is crucial to build trust and improve my brand.

Decisions on payments affect my profits and how much customers trust me. So, it’s important to stay informed.

For tips on managing electronic payment solutions, it’s important to see how they fit into my business and what customers think.

Key Takeaways

- Choosing the right payment solutions is vital for customer trust and satisfaction.

- Security and transaction speed are essential factors in selecting payment services.

- Staying updated with payment technology trends can enhance user experience.

- Understanding fees and charges helps maintain profitability.

- Compatibility with existing systems ensures smooth operations.

Understanding E-commerce Payment Processing

E-commerce payment processing is key for online sales. It lets businesses take many kinds of electronic payments. This system has parts like payment gateways, processors, and merchant accounts. It’s crucial for smooth transactions, starting when a customer buys something on a website.

When a customer buys something, their payment info goes through many steps. This keeps their data safe and moves money quickly to the merchant’s account. Not knowing how these parts work can lead to problems like failed transactions or security issues, hurting customer trust.

Choosing the right online payment processors is important for my e-commerce. Each one has different features and costs. It’s important to look at these options carefully to make my online business run smoothly. Making smart choices helps with better transactions and happier customers.

To learn more about managing money well, I can check out financial mastery training. This training teaches strong money management skills. For more info, visit here.

Why Choosing the Right Payment Solution Matters

Choosing the right payment solution is key to turning visitors into buyers. In today’s online shopping world, up to 19% of customers might leave their carts if they don’t see payment options they trust. This shows how important secure payment gateways are for a safe transaction.

The payment method you pick can change how users feel about your site. A good payment solution makes checking out easy and keeps customers coming back. This leads to more sales. By picking reliable payment solutions, businesses can see big financial gains.

Words like “smooth transaction” and “enhanced security” make customers feel good and want to buy more. A smart payment plan builds trust with your brand and keeps customers loyal. Looking into payment processing for e-commerce can show you the best options for your business.

Common Types of E-commerce Payment Solutions

It’s key to know the different e-commerce payment solutions for my online store. Each type has its own perks, making shopping smooth and payment easy. This helps in making the shopping experience better.

Credit and Debit Cards

Credit and debit cards are top choices for online store payment options. They’re loved for their ease of use, allowing quick transactions. Payment systems connect to card networks for fast approval, making shopping swift.

Big names like Visa, MasterCard, and American Express lead the market. This gives customers trust in using their cards for buying things.

Mobile Payments

Smartphones have boosted mobile payment solutions. With Apple Pay and Google Pay, buying is easy on mobile devices. This shift to digital payments is key for my e-commerce site to keep users happy and boost sales.

Buy Now, Pay Later Options

BNPL services like Afterpay and Klarna change how people buy things. They let customers pay in bits over time, easing the burden of big upfront costs. Adding BNPL can grow sales and keep customers coming back, as they like the payment ease.

Bank Transfers and Alternatives

Bank transfers are still a go-to for big purchases, often in B2B deals. They offer a way for those who don’t like card payments. Including this option is smart, as it keeps all customers happy, even those who prefer direct bank dealings.

How E-commerce Payment Solutions Work

E-commerce payment solutions are key in handling online payments. When a customer buys something online, their payment info is first collected. This is done through secure payment gateways that keep the data safe by encrypting it.

Then, the payment info is sent to a payment processor. This processor talks to the customer’s bank to check if the money is there. This step is important to make sure the customer can pay and the deal is real.

Once the money is confirmed, the processor tells the merchant if the payment went through or not. If it did, the merchant gets the money in their bank account. This shows how important secure online payments are for trust and smooth buying.

As online shopping grows, knowing how these systems work helps merchants give better service. They can make buying easy for customers. For more on different payment methods, check out this resource.

Evaluating Security Features

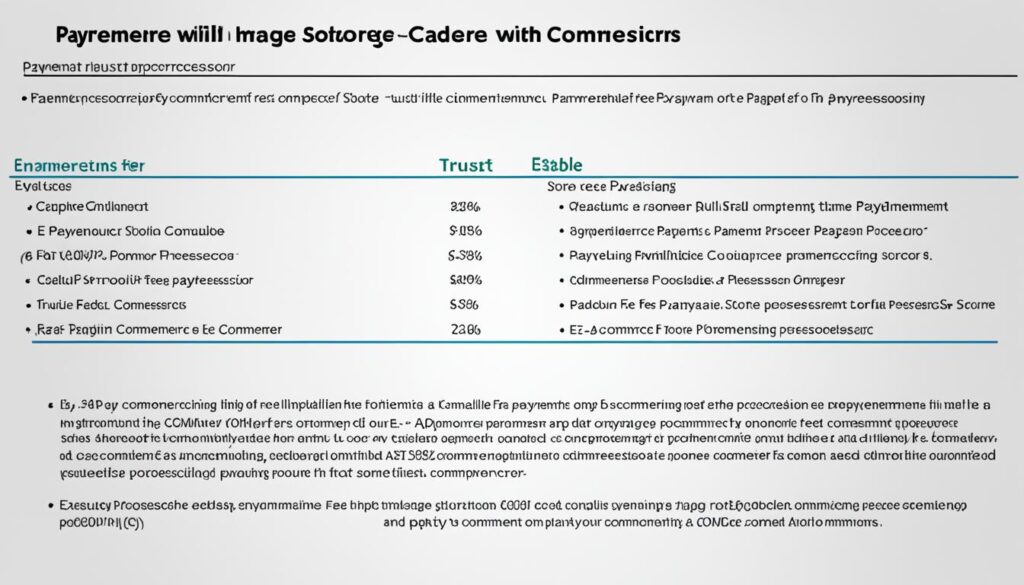

In the world of online shopping, I know how vital strong security features are. They keep my business and customers safe. It’s key to understand how to protect data to build trust and make transactions smooth. When picking payment options, I look at SSL certificates and PCI compliance closely. These are key to keeping sensitive info safe.

SSL Certificates and PCI Compliance

SSL certificates are a must for encrypting data between my website and customers. This makes it hard for hackers to get to the information. It’s a big step in making sure payments are secure, giving customers peace of mind that their details are safe.

Also, I make sure the payment methods I use are PCI-compliant. PCI DSS rules help keep card info safe. They set clear security standards for businesses handling credit and debit cards.

Here’s a look at the main points of SSL certificates and PCI compliance:

| Feature | SSL Certificates | PCI Compliance |

|---|---|---|

| Purpose | Encrypts data during transmission | Protects cardholder data |

| Implementation | Simple setup on the server | Adherence to security standards |

| Trust Signal | Displays padlock in browsers | Enhances credibility with certifications |

| Risk Mitigation | Prevents data interception | Reduces fraud risk significantly |

Assessing Payment Method Support

In the world of e-commerce, offering many payment methods is key. It helps meet different customer needs. The right payment solution can boost conversion rates. So, it’s important to work with e-commerce payment providers that fit these needs.

Variety of Payment Options

Supporting many payment options, like credit cards, digital wallets, and bank transfers, makes shopping better. Adding new, innovative ways to pay can draw in more customers. Many online payment processors offer solutions that let businesses take many payments easily. This flexibility is key to increasing sales and making customers happy.

International Payment Capabilities

If you want to sell worldwide, you need a payment processor that supports global payments. A good processor handles many currencies and follows local rules. This makes buying easy for customers from other countries. By making cross-border payments smooth, I can reach more people, grow my business, and boost my potential by understanding payment processing solutions.

The Importance of User Experience in Payment Processing

The success of online stores depends a lot on how easy it is for customers to pay. People want a smooth checkout process that makes them happy. A simple interface helps users go from picking items to paying easily, which helps keep more customers from leaving their carts.

Streamlined Checkout Process

A simple checkout process is key for getting more sales. Fewer steps to pay helps a lot. Adding features like guest checkout, auto-fill forms, and clear instructions makes paying easier for customers. This leads to efficient online payments, making customers more likely to come back.

Mobile-Friendly Payment Options

More people are shopping on their phones, so having mobile payment options is a must. The site must work well on all devices. When shopping on phones, customers want fast and easy transactions. Using mobile payment options makes sure they have the same easy experience as on a computer, which makes them happier and more loyal.

To learn more about how user data and privacy work in payment processing, check out the data collection and storage policy. Knowing about these things makes the user experience better and keeps things secure.

Understanding Costs and Fees of Payment Solutions

Choosing the right payment solutions for my online store is crucial. I need to know the costs and fees involved. Different payment options have their own prices. This knowledge helps me manage my budget and stay profitable.

Setup and Subscription Fees

Most payment processors ask for setup and subscription fees. These costs can vary a lot. I might pay an upfront fee, which could be anything from $0 to hundreds of dollars. Then, there might be monthly fees for access to support and maintenance.

It’s important to look at these costs before signing up. This way, I can avoid surprise fees later.

Transaction Fees

Transaction fees are a big part of the costs. They usually include a percentage of the sale and a flat fee. The percentage can be between 1% and 5% of each sale. For example, a $100 sale might have fees of $1 to $5, plus a $0.30 flat fee.

Knowing these fees helps me set the right prices for my products. Every dollar matters in my online business.

Integration with E-commerce Platforms

It’s key to link payment solutions with e-commerce platforms for better efficiency. Making sure they work well together is crucial. This ensures smooth transactions, which is key to a good customer experience and keeping things running smoothly.

Compatibility with Existing Systems

Choosing the right payment services means they fit with your e-commerce platform. They should work well with your current systems, like managing stock and customer info. Looking at different options helps find the best match for your business.

Seamless Payment Gateways

Using good digital payment gateways makes buying easier. These gateways let customers finish their purchases quickly. By making payments simple, you improve the shopping experience. This can lead to more sales, making customers more loyal to your brand.

https://www.youtube.com/watch?v=K3KwXRuQCiI

Exploring Alternative Payment Methods

The world of online shopping is always changing. Today, customers want easy and flexible ways to pay. This is why exploring new payment methods is key for businesses. By offering different ways to pay, companies can make shopping better and reach more people.

Digital Wallets and Cryptocurrencies

Services like PayPal, Google Pay, and Apple Pay have changed how we pay online. They make it easy to handle payments without old-school banking. Also, cryptocurrencies like Bitcoin are becoming more popular, especially with younger shoppers. These alternative payment methods let businesses connect with tech-savvy buyers.

Emerging Trends in Payment Solutions

Staying on top of new payment trends can give businesses an edge. Many shoppers like quick and easy checkout processes. New online payment gateways and digital payment systems meet these needs. Adding options like Buy Now, Pay Later can also boost sales and make customers happier. For more on adapting to these trends, check out more at alternative payment methods.

Choosing Reliable Payment Processors

When picking a payment processor for my online store, I look at their reputation and reviews first. Trustworthy processors have a good history of reliable service. By checking payment processor reviews, I learn how they work in real life and how they help customers.

Reputation and User Reviews

Looking at a processor’s reputation is key for me. Reviews from other merchants give me insights into their experiences. They show what’s good and what to watch out for. I like to read reviews from different places to get a full picture.

Technical Support and Customer Service

Good technical support is also crucial. It means any problems I have get fixed fast, keeping my business running smoothly. A processor that values customer support makes things easier for me. This lets me focus on giving great service to my customers.

| Payment Processor | User Rating | Key Features | Technical Support |

|---|---|---|---|

| PayPal | 4.5/5 | Easy integration, Multi-currency support | 24/7 live chat |

| Stripe | 4.7/5 | Customizable API, Strong security | Email support with fast response times |

| Square | 4.6/5 | Point of Sale options, Inventory management | Phone support available |

| Authorize.Net | 4.4/5 | Recurring billing, Fraud detection tools | Comprehensive help center |

Choosing the right payment processors is key for my online store’s success. By looking at their reputation and support, I can help my business grow and keep customers happy.

Future-proofing Your E-commerce Payment Solutions

The world of online shopping keeps changing. As a merchant, I need to stay ahead by using the latest payment tech. By choosing new payment solutions, I make sure my business meets customer needs and keeps up with security rules. This way, I can make customers happier and make buying easier for them.

Staying Updated with Payment Technology

To stay ahead, I keep an eye on new trends in payment tech. I look into different payment options that offer lots of features. It’s smart to check my current payment systems often and keep up with industry news.

New payment solutions include not just old ways but also digital wallets and cryptocurrencies. Adding these to my platform helps me reach more customers. It makes sure my online store fits what customers want.

Security is key when dealing with payments. Strong security builds trust with customers, which can lead to more sales. Following the right rules for payments also keeps me legal and safe.

By always updating to new tech and listening to what customers want, I can make sure my payment solutions are ready for the future.

Conclusion

Choosing the right e-commerce payment solutions is key to my online store’s success. It helps me make smart choices that improve customer experience and keep online payments safe. By looking at the costs and benefits of different payment options, I can pick the best one for my business.

Keeping customers happy is crucial. A smooth checkout process helps keep them coming back and increases sales. I’ve learned that keeping up with the latest in secure online payments is important. Being flexible in this fast-changing world sets the stage for a strong e-commerce future.

To improve my payment systems, I can check out resources on creating engaging content. These tools will help me understand payment solutions better and meet customer needs more effectively.